Contents

Role and Functions of RBI

- The concept of RBI came from the book, “The Problem of the Rupee: its Origin and its Solution” 1923, by Dr. B. R. Ambedkar.

- The Reserve Bank of India was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934.

- It was established based on the suggestions of “Royal Commission on Indian Currency & Finance” in 1926.

- This commission was also known as Hilton Young Commission.

>>>>>>

>>>>>>

- The Central Office of the Reserve Bank was initially established in Calcutta but was permanently moved to Mumbai in 1937.

- The Central Office is where the Governor sits and where policies are formulated.

- RBI was nationalised on 1st Jan 1949

- Financial year of RBI is from 1st July to 30th June.

- From financial year 2021-22 it will be April-March.

- A palm tree and a Tiger is the emblem of the Reserve Bank of India.

- 1935 – 1st Governor of RBI was Sir Osborne Smith.

- 1943 – 1st Indian Governor of RBI was CD Deshmukh, who participated in Bretton Woods Conference, in 1944.

- 2003 – 1st woman deputy Governor of RBI was KJ Udeshi.

- The only Prime Minister who was the Governor of RBI was Manmohan Singh.

>>>>>>

>>>>>>

Central Board of Directors of RBI

- The Central Board of Directors is the administrative apex body of the Reserve Bank of India.

- The total no. of members can be a maximum 21.

- The board is appointed by the Government of India in keeping with section 8 of the RBI Act.

- Section 7 empowers the government to supersede the RBI Board and issue directions to the central bank if they are considered to be “necessary in the public interest”.

- The director of the RBI Board cannot be

- a salaried government official (except a specifically nominated member of the Government)

- be adjudicated as insolvent or have suspended payments to creditors

- an officer or employee of any bank

- found lunatic or becomes of unsound mind

>>>>>>

Official Directors of Reserve Bank of India

- Full-time directors

- 1 Governor and up to 4 Deputy Governors

- Governor and Deputy Governors hold office for max period of 5 years.

- The term of the governor may be fixed by the government at the time of his appointment.

- They are eligible for reappointment or extension as per Section 8 (4) of the Reserve Bank of India Act.

- The appointment has been made based on the recommendation of the Financial Sector Regulatory Appointments Search Committee (FSRASC), headed by the Cabinet Secretary.

- Salaries and allowances are determined by CBD, with the approval of the Central Government.

- The governor can be removed by the government of India.

>>>>>>

Non-Official Directors of Reserve Bank of India

- Nominated by the Government of India.

- Up to 10 Directors from various fields and 2 government Official

- 10 Directors hold office for 4 years, and government officials are to hold a term on RBI Board as long as the government want.

- Other 4 Directors – one each from four local boards

>>>>>>

Powers of the Central Board of Reserve Bank of India

- Board exercises all powers and does all acts and things that are exercised by the Reserve Bank of India.

- Board recommends to the government the design form, and material of bank notes and also when and where they can serve as legal tender.

>>>>>>

Meeting of Central Board of Reserve Bank of India

- Governor has to call a Board meeting at least 6 times in a year, and at least 1 each quarter.

- The meeting can be called if a min of 4 Directors ask Governor to call a meeting.

- In absence of Governor, Deputy Governor authorised by him to vote for him and presides over the Board meetings.

- In the event of split votes, Governor has a 2nd, or deciding vote.

>>>>>>

Local Boards of Reserve Bank of India

- There are one local board for each four regions of the country in Mumbai, Calcutta, Chennai, and New Delhi.

- It consists of five members each.

- Local Boards are appointed by the Central Government.

- It has a term of 4 years.

>>>>>>

Enforcement Department

- It started in 2017.

- It will enforce all laws to the banks or others as per surveillance from different departments of RBI.

>>>>>>>>

>>>>>>>>

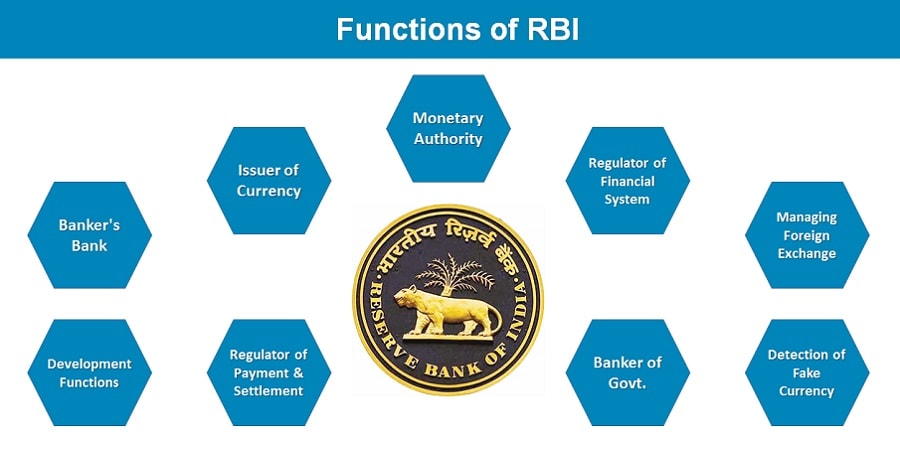

Role & Functions of RBI

Monetary Authority

- The main functions of RBI are to formulate, implement and monitor the monetary policy.

- Target of monetary policy

- Maintaining price stability, keeping inflation in check

- Ensuring adequate flow of credit to productive sectors

>>>>>>

Regulator & Administrator of the Financial System

- The Reserve Bank of India controls the monetary supply in India.

- It monitors economic indicators like the GDP, CPI etc.

- Decide the design of the rupee banknotes as well as coins.

- RBI is to undertake supervision of the financial sector comprising commercial banks, financial institutions and non-banking finance companies.

- Banking Ombudsman Scheme has formulated by Reserve Bank of India for consumer Complaints.

- RBI lays out parameters of banking operations within which all the banking and financial system functions for

- maintaining public confidence in the system

- protecting depositors’ interest

- providing cost-effective banking services to the public

>>>>>>

Managing Foreign Exchange

- Reserve Bank of India manages Forex under the FEMA- Foreign Exchange Management Act, 1999.

- Facilitate external trade and payment.

- Promote the development of foreign exchange market in India.

>>>>>>

Issuer of Currency

- Reserve Bank of India is authorized to issue currency in India except Rs.1 notes.

- One rupee notes printed by the Ministry of Finance.

- The bank also destroys the same when they are not fit for circulation.

- All the money issued by the central bank is its monetary liability.

- Security Printing and Minting Corporation of India Limited (SPMCIL), prints note for RBI.

- It is a wholly owned company of the Govt. of India.

- SPMCIL has 2 printing presses at

- Nashik, Maharashtra

- Dewas, MP

- Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL), also has set up printing presses

- Mysore in Karnataka

- Salboni in West Bengal

- SPMCIL has 4 mints for coins

- Mumbai

- Alipore (Kolkata)

- Hyderabad

- NOIDA (UP)

- Govt. of India has the sole right to mint coins as per the Coinage Act, 1906.

>>>>>>

Developmental Functions of RBI

- Reserve Bank of India faces a lot of inter-sectoral and local inflation-related problems.

- Key tools in this effort is Priority Sector Lending.

- RBI work towards strengthening and supporting small local banks.

- Encourage banks to open branches in rural areas to include large section of society in banking network.

>>>>>>

Regulator of the Payment & Settlement Systems

- Payment and Settlement Systems Act of 2007 (PSS Act) gives the RBI authority, including regulation and supervision, for the payment and settlement systems in the country.

- In this role, the RBI focuses on the development and functioning of safe, secure and efficient payment and settlement mechanisms.

- Two payment systems NEFT and RTGS managed by Reserve Bank of India.

>>>>>>

Banker & Debt Manager to Government

- As a banker to the GoI, RBI maintains its accounts, receive payments into & make payments out of these accounts.

- RBI also helps GoI to raise money from public via issuing bonds and govt. approved securities.

>>>>>>

Banker’s Bank

- It works as a central bank where commercial banks are account holders and can deposit money.

- Reserve Bank of India maintains banking accounts of all scheduled banks.

- It is the duty of the Reserve Bank of India to control the credit.

- The RBI also advises the banks on various matters for example Corporate Social Responsibility.

>>>>>>

Detection of Fake Currency

- Reserve Bank of India has launched a website to raise awareness among masses about fake notes.

>>>>>>>>

>>>>>>>>

Reserves of RBI

Foreign Exchange Reserve (Forex Reserve) of India

- Foreign Currency Assets

- Gold

- Special Drawing Rights (SDRs)

- Reserve Tranche Position

>>>>>>

Special Drawing Rights (XDR)

- Special Drawing Rights is a supplementary foreign-exchange reserve assets defined and maintained by the International Monetary Fund (IMF).

- The XDR is the unit of account for the IMF, and is not a currency.

- Special Drawing Rights was created in 1969 to supplement a shortfall of preferred foreign-exchange reserve.

- XDR basket consists of

- USD

- Euro

- Renminbi (Chinese yuan)

- Japanese yen

- British pound

>>>>>>

Reserve Tranche Position (RTP)

- Reserve Tranche Position is the difference between a member’s quota and the IMF’s holdings of its currency.

- It is an emergency account that IMF members can access without agreeing to conditions or service fee at any time.

>>>>>>

Asset Development Fund

- Asset Development Fund was created in 1997-98.

- It helps to meet the internal capital expenditure and new investments in RBI’s subsidiaries and associate institutions.

>>>>>>

Currency & Gold Revaluation Reserve (CGRA)

- The CGRA is meant to cover a situation where

- Rupee appreciates against one or more of the currencies in the basket

- There is a decline in the rupee value of gold

- The basket has several currencies ranging from the dollar to the euro and the yen.

- The level of CGRA now covers about a quarter of the total currency reserves of the Reserve Bank of India.

>>>>>>

Contingency Fund Reserve of RBI

- It used to cover depreciation in the value of the RBI’s holdings of government bonds domestic and foreign.

- It used when yields rise and their prices fall.

- To cover expenses from extraordinary events such as demonetization, money market operations, and currency printing expenses in a year of insufficient income.

- This reserve supports the mother of all guarantees – central bank’s role as the lender of the last resort.

- It covers the deposit insurance for Deposit Insurance and the Credit Guarantee Corporation (DICGC) a subsidiary of Reserve Bank of India.