Contents

>>>>>>

- National Payments Corporation of India (NPCI) is an umbrella organization for all retail payment system in India.

- It is under the provisions of the Payment and Settlement Systems Act, 2007.

- NPCI was set up with the guidance and support of the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA).

- National Payments Corporation of India has 10 promoter banks.

- In 2016 the shareholding of NPCI was broad-based to 56 member banks to include more banks representing all sectors.

- NPCI has been incorporated as a “Not for Profit” Company.

>>>>>>

>>>>>>

NPCI Developments

Bharat Bill Payment System (BBPS)

- Bharat bill pay is an integrated bill payment system in India

- It enables multiple payment modes, and providing instant confirmation of payment.

>>>>>>

>>>>>>

National Electronic Toll Collection (NETC)

- NETC offers an interoperable nationwide toll payment solution

- It enables a customer to use their FASTag as payment mode on any of the toll plazas

>>>>>>

FASTag

- FASTag is a device that use Radio Frequency Identification (RFID) technology

- It enables automatic toll payments while the vehicle is in motion.

- FASTag (RFID Tag) is affixed on the windscreen of the vehicle

- It enables a customer to make the toll payments directly from the account which is linked to FASTag.

- FASTag was 1st used as a pilot project in 2014 on the Golden Quadrilateral between Ahmedabad and Mumbai.

>>>>>

>>>>>>

Aadhaar Enabled Payment System (AePS)

- AePS is a bank led model which allows online interoperable financial inclusion transaction at PoS (Micro-ATM) through the Business correspondent.

- AePS allows you to do six types of transactions.

- Cash Withdrawal

- Cash Deposit

- Balance Enquiry

- Aadhaar to Aadhaar Fund Transfer

- Mini Statement

- Best Finger Detection

>>>>>>

>>>>>>

National Automated Clearing House (NACH)

- NACH is a centralised system, consolidate multiple ECS systems running across the country

- It uses as an automated monthly payments system

- NACH’s Aadhaar Payment Bridge (APB) System helping the Government in making the Direct Benefit Transfer scheme a success.

>>>>>>

>>>>>>

National Financial Switch (NFS)

- NFS maintains high standards of application and network for ATM in India.

- It allows Cash Withdrawal, Balance Enquiry, PIN Change and Mini Statement, Interoperable Cash Deposit, Mobile Banking Registration, Card-to-Card Fund Transfer etc.

>>>>>>

>>>>>>

Cheque Truncation System (CTS)

- Extended cut off time for acceptance of Customer Cheques by banks.

- Cheque Truncation System is an easy way to retrieval of information.

- It reduces timelines for clearing Cheques.

>>>>>>

>>>>>>

Unified Payments Interface (UPI)

- Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application

- It is merging several banking features, seamless fund routing & merchant payments into one hood.

- UPI enables “Peer to Peer” collection or sending money

- It was launched on 11th April 2016.

- UPI enables immediate money transfer through mobile device round the clock 24*7 and 365 days.

- Only fixed and savings account could be linked with UPI.

- Upper limit per UPI transaction is Rs.1 Lakh.

- UPI, built based on IMPS technology.

- There is no need to pre-load money in wallets to transfer through UPI.

>>>>>>>>

UPI-2

- Customers can now link their overdraft (OD) account

- Invoice to Inbox feature for verified merchants

- Check the merchant’s credentials using a QR code

- One Time Mandate feature, which allows users to schedule a payment

>>>>>>

>>>>>>

Bharat Interface for Money (BHIM)

- It is an app that lets you make simple, easy and quick payment transactions using Unified Payments Interface (UPI).

- You can make instant bank-to-bank payments and Pay and collect money using just Mobile number or Virtual Payment Address (UPI ID).

>>>>>>

>>>>>>

BHIM Aadhaar Pay

- It enables Merchants to receive digital payments from customers over the counter through Aadhaar Authentication.

- Per transaction limit is Rs.10,000

>>>>>>

>>>>>>>

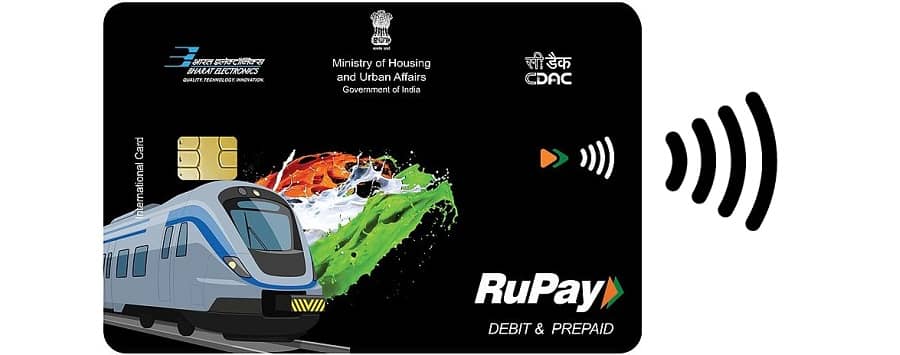

RuPay Card

- RuPay is a card payment system like Visa or Masters card.

- Transaction charges for using RuPay is much lower than other international cards.

- It would lead to lower cost of clearing and settlement for each transaction.

- RuPay also promote digital transaction in rural India.

- Now RuPay card can be used in Singapore, Bhutan, UAE and some other country.

>>>>>>>

RuPay Contactless

- RuPay Contactless specifications are open standards, interoperable and scalable and can be adopted by all card schemes.

- To provide a mechanism for including Low Value Payments (LVPs)

- This card can be used for transit payments (Bus, Metro, Cab etc.), toll, parking, small value offline retail payments as well as normal day to day retail payments.

- Target of Government of India for implementation of National Common Mobility Card (NCMC) program across the country with the vision of ‘One Card for all Payments

>>>>>>

>>>>>>

Bharat QR

- It is Person to Merchant (P2M) Mobile payment solution.

- User can scan these QR via BQR enabled mobile banking app and pay using Card linked account / VPA / IFSC + Account / Aadhaar.

>>>>>>

>>>>>>

*99#,

- It is a USSD based mobile banking service of NPCI was initially launched in November 2012.

- The service had limited reach and only two TSPs were offering this service MTNL & BSNL.

>>>>>>