Contents

Monetary Policy by RBI

Monetary Policy by RBI

- Monetary policy is the process by which monetary authority of a country (RBI) maitain the supply of money in the economy.

- Monetary authority control over interest rates in order to maintain price stability and achieve high economic growth.

>>>>>>>

>>>>>>>

Monetary Policy Objectives of RBI

Price Stability

- Price Stability promotes economic development and controlling inflation or deflation and exchange rate.

Controlled Expansion of Bank Credit

- One of the important functions of RBI is the controlled expansion of bank credit and money supply in the economy

Promotion of Fixed Investment

- The aim here is to increase the productivity of investment by restraining non-essential fixed investment.

Restriction of Inventories & Stocks

- Main objective of this policy is to avoid over-stocking and idle money in the organization.

To Promote Efficiency

- To increase the efficiency in the financial system

- Tries to incorporate structural changes such as deregulating interest rates, ease operational constraints in the credit delivery system etc.

Reducing the Rigidity

- RBI tries to bring flexibility in the operations which provide a considerable autonomy.

- It encourages more competitive environment and diversification.

- It maintains its control over financial system wherever necessary to maintain the discipline.

>>>>>>

>>>>>>

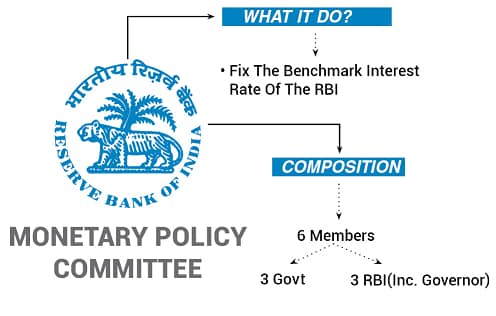

Monetary Policy Committee

- The Reserve Bank of India Act, 1934 (RBI Act) was amended by the Finance Act, 2016.

- It provides a statutory framework for a Monetary Policy Committee.

- Monetary Policy Committee (MPC) is a statutory body, started in 2016.

- MPC is a 6 members body

- 3 officials of the RBI

- 3 external members nominated by GoI

- Nominated members’ term is 4 years, no reappointment.

- They recommended by Search-cum-Selection Committee

- Cabinet Secretary

- Governor of RBI

- Secretary Department of Economic Affairs

- 3 experts in related fields

- MPC is required to meet at least 4 times in a year.

- The quorum for the meeting of the MPC is 4 members.

- Each member of the Monetary Policy Committee has one vote, and Governor has a 2nd or casting vote.

- Once in every 6 months, RBI will publish Monetary Policy Report to explain

- the sources of inflation

- the forecast of inflation for 6-18 months ahead

- As per Section 45ZA, Govt. determine the inflation target in term of CPI one in every 5 years.

- Minutes of the meeting have to publish in 14th day.

Types of Monetary Policy

- Exchange rate stability – Export oriented economics.

- Multiple Indicators – Growth, Employment, Inflation, Exchange rate.

- Inflation Targeting.

Flexible Inflation Targeting Framework

- Urjit Patel committee recommended it 2013-14.

- Target inflation is 4% +- 2%, min 2% and max 6%.

- So the main target of monetary policy is inflation.

- If inflation > 4%, then RBI will go with tight monetary policy, high interest rate.

Benefits

- Predictability of policy based on the prevailing inflation.

- More price stability and check inflation.

- Relatively less volatile economy, which will help for FDI and domestic business.

- Increases transparency in policy making (minutes of meeting).

Challenges

- Inflation in India depends on poor supply chain also.

- Growing economies are generally have high inflation, because of miss match of supply and demand.

- Inflation targeting may curtail liquidity flow, which can effect growth

- Fiscal policy also a main cause of inflation.

- Oil and agri product has more price volatility, cause of less control on oil price and monsoon.

E-Kuber

- It is the Core Banking Solution (CBS) of RBI.

- This site used by all the banks for transaction with RBI.

- E-Kuber provides a single current account for each bank across the country.

- Auction of Government securities is also done through e-kuber system.

- It has different windows

- OMO – Open Market Operation

- MSS – Market Stabilisation Scheme

- LAF – Liquidity Adjustment Facility

- MSF – Marginal Standing Facility

- SDF – Standing Deposit Facility (not started yet)

Instruments of Monetary Policy

- Quantitative or Indirect tool

- Qualitative or Selective tool

>>>>>>

>>>>>>

Quantitative or Indirect Tool

Repo Rate

- Repo rate is a fixed interest rate at which the Reserve Bank provides overnight loan to banks against govt. and other approved securities.

- Repo rate facility works under the liquidity adjustment facility (LAF).

- It’s also called “Policy rate” and “Rate of repurchase“.

- RBI introduced Repo auctions in Dec 1992.

- Banks can’t use SLR securities for this system

- Minimum borrowing 5 Cr.

Reverse Repo Rate

- Fixed interest rate at which the Reserve Bank absorbs liquidity, on an overnight basis, from banks against the collateral of eligible govt. securities under the LAF.

Liquidity Adjustment Facility (LAF)

- It allows banks to borrow money through repurchase agreements.

- LAF is used to aid banks in adjusting the day to day mismatches in liquidity.

- LAF consists of repo and reverse repo operations.

- It started in India in April 1999, on the recommendations of Narasimham Committee – 1998.

Marginal Standing Facility (MSF)

- Marginal Standing Facility is a new Liquidity Adjustment Facility (LAF) window created by RBI in 2011.

- MSF is the rate at which the banks are able to borrow overnight funds from RBI against the approved government securities.

- Only scheduled commercial bank can use it (exclude RRB)

- Min 1 Cr. Can be borrowed

- Banks can use SLR securities

Corridor

- It is the difference between the reverse repo rate and the high cost MSF rate.

- Ideally, the call rate should travel within the corridor showing a comfortable liquidity situation in the financial system and economy.

Bank Rate

- It is the rate at which RBI buy or rediscount bills of exchange or other commercial papers.

- This rate has been aligned to the MSF rate and, therefore, changes automatically as and when the MSF rate changes

- It’s a long term system of borrowing by Banks.

Reserve Deposit Ratio

- It has 2 parts

- CRR

- SLR

Cash Reserve Ratio (CRR)

- CRR is the average daily balance that a bank is required to maintain with the Reserve Bank of India.

- It’s a per cent of bank’s Net demand and time liabilities (NDTL).

- No interest is paid by the RBI against the CRR.

Statutory Liquidity Ratio (SLR)

- SLR is the share of NDTL that a bank is required to maintain in safe and liquid assets.

- SLR can be government securities, T-Bill, cash and gold.

- Changes in SLR often influence the availability of resources in the banking system for lending.

- Primary society Cooperative banks no need to keep SLR.

- RBI can prescribe different SLR for NBFCs.

Open Market Operations (OMOs)

- These include purchase and sale of government securities, for injection and absorption of durable liquidity, respectively.

- It’s a part of Govt. borrowing.

Market Stabilization Scheme (MSS)

- This instrument was introduced in 2004.

- Surplus liquidity is absorbed through sale of short-dated government securities and treasury bills.

- The cash so mobilised is held in a separate government account with the Reserve Bank.

- MSS doesn’t increase Govt. debt.

- Upto 2 years maturity G-securities, 365 days T-bill, 90 days Cash management Bill.

- RBI used it during demonetization to absorb extra liquidity from Banks.

- MSS limit is 6 lac Cr., before demonetization it was 30K Cr.

Standing Deposit Facility (SDF)

- A strong tool to suck out the surplus liquidity

- Recommended by the Urjit Patel committee report in 2014

- Without collateral

- Without limit

>>>>>>>

Dear Money & Cheap Money Policy

| Monetary Policy | Dear money or Hawkish Policy | Cheap money or Dovish Policy |

|---|---|---|

| Target | To fight inflation | To fight deflation |

| Reserve Ratio (CRR, SLR) | Increase them | Decrease them. |

| Open Market Operation (OMO) | RBI sell securities | RBI buy securities |

| Bank Rate | increase it | decrease it |

| Repo rate | increase it | decrease it |

| Results | Money supply decreases | Money supply increases |

| Interest rate rises | Interest rate falls | |

| Investment expenditure declines | Investment increases | |

| Demand declines | Demand increases | |

| Price level falls | Output and price increases |

>>>>>>

>>>>>>>

Qualitative Tool

Credit Control

- RBI and Govt. restricts the lending capacity of a bank with rules or schemes.

- 1968: first time RBI used the word “priority sector – target 40% by 1985

- 1968: Export credit interest subsidy

- 1969 nationalization round 1 : 14 banks nationalized

- 1971: Credit Guarantee Corporation of India Ltd. established. To facilitate bank lending to the priority sectors.

- 1972: Differential interest rate scheme in PSB: for low income groups

- 1980: Bankers to give more loans to Indira’s 20-Point program for removing poverty & reviving economy

- 2006: Interest subvention scheme for farmers (7-3=4%)

- 2016: Interest subvention Home loans (post-demonetization)

Priority Sector Lending – PSL

- Schedule commercial banks has to lend 40% of its total credit as Priority Sector Lending.

- RRB, Local Area Banks, Small Finance Banks has to lend 75% to Priority Sectors.

- Other banks or NBFC no need to follow PSL rules.

- Banks need to give report on Priority Sector Lending, every 4 months.

- Banks can give funds to Rural Infrastructure Development Fund (RIDF) and other funds of some organizations in case of short fall in target.

- Those organizations are

- NABARD

- NHB

- SIDBI

- MUDRA

>>>>>>

>>>>>>

Priority Sectors

- Agriculture – 18%

- Export related business

- Education

- Small Housing

- MSME

- Social Infra

- Renewable Energy

- Other ( personal loan to weaker section, SC/ST organizations etc.)

PSL Certificate – 2016

- Bank can purchase this certificate to fulfill PSL target in case of short fall.

- Only loan amount is transferred not the risk

- PSL certificate can be bought via E-Kuber

Interest Subvention Scheme

- It’s a type of subsidy by Govt. to priority sectors

- NABARD maintain this process

Rural Infrastructure Development Fund (RIDF)

- RIDF came into existence in 1996

- Primary purpose of encouraging commercial banks to meet their PSL targets lower interest on investment under RIDF as compared to net returns on priority sector advances.

- Currently, the interest rate levied on RIDF varies from 2% to 4% below bank rate depending on the extent of shortfall in PSL targets.

Consumer Credit Control

- It’s a one type of qualitative tool

- By this way also RBI can maintain the money supply in market

- RBI can change the rules for minimum down payment, EMI

- By this process market demand will be control

Margin Requirements

- People will get a loan against Collateral Security.

- Margin is the percentage of the value of collateral security against which loan is not given.

- RBI can change the margin against a particular security to encourage or discourage the flow of credit to a particular sector.

- If the margin is high, then the sanctioned loan will be less.

Publicity

- RBI uses media for the publicity of its views on the current market condition and its directions that will be required to be implemented by the commercial banks to control the unrest.

Moral Suasion

- RBI give suggestion to states to control fiscal deficit.

- Suggestion to banks for purchasing more G-sec than SLR

Direct Action

- As per Banking Regulation Act, 1949, RBI can impose penalty on any banks.

- No complain can be filed against it by banks in any court of law.

Limitation of Monetary Policy

Low Deposit Growth in Banks

- Inflation

- Small saving schemes has more interest (Ex: kishan vikas patra)

- Outward remittance & money laundering

- Leakage or Black money

- High Election expenditure

- Low Financial inclusion or low deposit behavior in villages

Increasing spread of Banks

- Spread is the margin of banks or the difference of the interest rate of Depositor and lenders

- Losses due to NPA

- Less demand from corporates

- Less demand from aam admi

Economy is not 100% monetized

- Land resources – companies cant buy land or start mine as per wish

- Labour – they are not paid in money always mainly agriculture

- Unorganized sector – high credit doesn’t improve the productivity

>>>>>>