Contents

banking in india types of banks

- Banks are the financial institution that takes deposits from public and gives credit to any individuals or organizations.

- Banking in India is regulated by RBI Act, 1934, Banking Regulation Act, 1949 and FEMA.

- Supervision over all the banks in India, lies with the Department of Banking Supervision (DBS).

- The types of banks in India are divided depend on their functions which is guided by Reserve Bank of India Act, 1934.

- Financial institutions can be divided into two types

- Banking Institutions

- Non-Banking Financial Institutions

- We can divide banking institutions of India in two way

- Depend on the Banking Regulations & Act

- Depend on their Roles & Functions

banking in india types of banks

banking in india types of banks

Types of Banks depend on RBI Act, 1934

- Scheduled Banks

- Non-Scheduled Banks

Types of Banks depend on Functions

- Commercial Banks

- Cooperative Banks

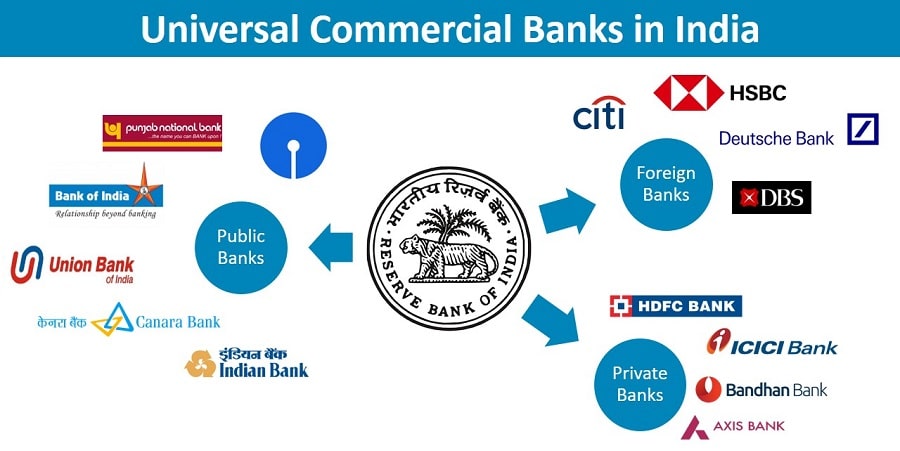

Types of Commercial Banks in India

- Universal Commercial Banks

- Public

- Private

- Foreign

- Differential Commercial banks

- RRB – Regional Rural Bank

- Local Area Bank

- Small Finance Bank

- Payment Bank

- Wholesale Bank

banking in india types of banks

Types of Cooperative Banks in India

- Urban

- State

- Central

- PACS – Primary Agricultural Credit Societies

Types of Non-Banking Financial Institutions in India

- Development Bank or All India Financial Institution

- EXIM Bank

- NABARD – National Bank for Agriculture and Rural Development

- NHB – National Housing Bank

- SIDBI – Small Industries Development Bank of India

- PD – Public Depository

- NBFC – Non Banking Financial Companies

banking in india types of banks

banking in india types of banks

Scheduled Banks

- Scheduled banks are come under the 2nd Schedule of the Reserve Bank of India Act, 1934.

- Banks need to satisfy the criteria in the section 42(6)(a) of the RBI Act 1934 to be in 2nd schedule.

- Bank has a minimum paid-up capital of Rs. 5 Lac.

- Bank must not carried out any business that causes harm to the interest of the depositors.

- Scheduled banks in India should be a corporation, not a sole-proprietorship or partnership firm.

- There are some more obligations that a Scheduled bank need to fulfill

- Scheduled Banks in India need to maintain Cash Reserves with RBI.

- They must submit the periodic returns to the RBI.

- Scheduled banks in India enjoy certain rights

- Scheduled banks can receive refinance facility from the Central Bank

- They have access to the repo market of RBI.

- They entitled for currency chest facility

- Right to become members of clearing house

- Scheduled banks are two types, commercial banks and cooperative banks

- Public deposits in Scheduled Banks in India are insured by Deposit Insurance and Credit Guarantee Corporation (DICGC)

- DICGC insured bank deposits of up to Rs.5 lac per depositor per bank in the situation of bank failure.

Currency Chest

- Currency chests are branches of banks selected by the RBI to stock rupee notes and coins.

- RBI branch offices receive the notes from note presses and coins from the mints.

- Then notes and coins are sent to the currency chests.

- RBI has set up about 5000 currency chests all over the country.

- More than 60% currency chests are in branches of the State Bank of India and other PSU banks have about 35%.

Clearing House

- A bankers’ clearing house is a financial institution that clear cheques and transfers money between member banks.

- Now this is done electronically through 9 digit Magnetic Ink Character Recognition (MICR) code.

- RBI branch offices or SBI and PSU banks work as the clearing house.

Non-Scheduled Banks

- Non-Scheduled Banks are not listed in the 2nd Schedule of Reserve Bank of India.

- They do not comply with the provisions of the Reserve Bank of India Act, 1934.

- RBI, are not able to protect the depositor’s interest in the case of Non-Scheduled Banks in India.

- This banks are need to maintain the cash reserve ratio with themselves, but not with the RBI.

- Non-Scheduled Banks can be two types, commercial and cooperative

- Non-Scheduled Commercial Banks

- Local Area Banks are non-scheduled banks

- Non-Scheduled Cooperative Banks

- Non-Scheduled State Cooperative Banks

- Primary Agricultural Credit Societies

banking in india types of banks

banking in india types of banks

Commercial Banks in India

- A commercial bank is a type of bank that provides different financial services for making profits.

- Commercial banks are the most important components of the banking system in India.

- The Banking Regulation Act, 1949 empowers the RBI to inspect and supervise commercial banks.

- All the commercial banks are need to maintain CRR and SLR

- Minimum Priority Sector Lending (PSL) is 40% of their total loans or Adjusted Net Bank Credit.

- Commercial banks in India can access repo market.

Core Functions of Commercial Banks

- Credit creation or lending activity is the most important function of commercial banks.

- Lending money by overdraft, and loans

- Lending both secured and unsecured credit.

- Commercial banks accept deposits from customers

- Demand deposit

- Time deposit

- Issuing Bank drafts and Bank cheques.

- Processing payments through internet banking, RTGS or other payment methods.

- Providing cash management services, management of payments and receives for clients.

- They provide Treasury management services.

- Commercial banks can provide Private Equity financing but cannot invest in financial market.

Agency Functions of Commercial Banks

- Commercial banks collect and clear cheques, dividends and interest warrant.

- They can sell Insurance, Mutual Fund, Pension to customers.

- Commercial banks in India deal in foreign exchange transactions for individual and businesses.

- Provide purchase and sell securities services to clients.

- They act as trustee, attorney, correspondent and executor.

- Commercial banks accept tax proceeds and tax returns.

Utility Functions of Commercial Banks

- Commercial banks in India provide safe deposit boxes to customers.

- They provide money transfer facility to public.

- Provide bill payment service for phone bills, rent, gas bills, water bills etc. to customers.

- Commercial banks provide various cards such as credit cards and debit cards.

banking in india types of banks

banking in india types of banks

Universal Commercial Banks

Public Banks in India

- These are the nationalised banks, more than 51% shares is under Government control.

- Public banks in India account for more than 75% of the total banking business in the country.

- SBI is the largest public sector bank in India and one among the top 50 banks of the world after merger.

- In 2017, there was 27 nationalised banks in India.

- Now, there are 12 nationalised banks in India after merger in Aug, 2019.

- FDI limit in Public sector banks in India is 20% including FII.

Private Bank in India

- Major stake or equity of a Private bank is held by private shareholders.

- All the banking rules and regulations of RBI will be applicable on private sector banks as well.

- FDI limit is 74% including FII in any private bank in India

- Minimum paid up capital is Rs. 500 Cr.

- Private banks must have at least 25% branches in rural centres (population less than 10K).

- Organizations should have a past record with a successful track record of 10 years to apply for a private bank in India.

- There are more than 20 private sector banks in India.

Foreign Banks in India

- A foreign banks, which have headquarters in a foreign country can operates in India as a private entity.

- They need to open their benches under Wholly Owned Subsidiary.

- At least 25 % of the total number of branches must be opened in unbanked rural area, Tier 5 and Tier 6.

- PSL is 40% for those which have more than 20 branches

- PSL is 32% for foreign banks with less than 20 branches.

- 100% FDI is allowed for wholly owned subsidiary of foreign banks in India.

- There are more than 45 foreign banks are banking in India.

Differential Commercial Banks in India

Regional Rural Bank (RRB)

- Regional Rural Banks or RRBs are also scheduled commercial banks

- RRBs were set up on the recommendations of the Narshimham committee, in 2nd Oct, 1975

- It also known as Gramin banks.

- They usually operate at rural areas in India.

- Regional Rural Banks may have branches in selected urban areas also.

- Ownership of Regional Rural Banks in India is as follows

- Central Government – 50%

- State Government – 15%

- Sponsor Banks – 35%

- Priority Sector Lending is 75% of net bank credit.

- Operating area is restricted within the state or some districts.

- Regional Rural Banks can’t use MSF facility of RBI.

- 1st Regional Rural Bank in India was the Prathama Bank sponsored by Syndicate Bank in Uttar Pradesh

Functions of Regional Rural Banks

- Regional Rural Banks have been created to provide banking facilities to rural and semi-urban areas.

- RRBs do the Government operations like disbursement of wages of MGNREGA workers, distribution of pensions, etc.

- Para-Banking facilities like debit cards, credit cards and locker facilities also provided by RRBs.

Local Area Banks (LABs)

- Local area bank was introduced in Aug, 1996.

- It was expected to bridge the gaps in credit availability and strengthen the institutional credit framework in the rural and semi-urban areas.

- Local area banks are non-scheduled commercial banks.

- They were given permission under Section 22 of the Banking Regulation Act 1949.

- LABs could be included in the 2nd Schedule of the RBI Act, 1934 subject to the fulfillment of the eligibility criteria

- Min start-up capital of a LAB was fixed at Rs.5 cr.

- Maximum operational area of 3 districts.

- Minimum PSL is 40%

- 25% of their PSL (10% of NBC) must lend to the weaker sections of society.

- Local area banks in India need to maintain CRR and SLR

- 1st LAB in India is Coastal Local Area Bank, in Andhra Pradesh, established in 1999.

- In 2014, RBI has permitted Local area banks to be converted into small finance banks as per eligibility.

banking in india types of banks

Small Finance Bank in India

- Objectives of setting up of small finance banks financial inclusion to the unserved sections of the society by

- Providing savings vehicles

- Supply of credit to small and micro business units, small and marginal farmers

- Providing financial services through high technology-low cost operations.

- Small finance banks set up on the recommendations of Nachiket Mor Committee 2014

- Eligibility criteria to set up small finance banks are

- Resident individuals with 10 years of experience in banking and finance

- Companies and societies owned and controlled by residents

- Existing NBFCs, Micro Finance Institutions, LABs

- Minimum paid up capital for small finance banks is Rs.100 cr.

- FDI limits is same as private sector banks.

- Small finance banks can be converted into a private sector bank after 5 years, as per performance.

- The area of operations of small finance banks is not restricted.

- At least 50% of its loan should not be more than Rs. 25 lakh.

- Minimum PSL is 75% in which 40% is as per RBI guide and 35% is for preferred sector as per bank.

- CSR and SLR and other rules for commercial private banks is applicable on small finance banks too.

- CRAR is 15% for small finance banks in India.

- 1st small finance bank in India is Capital Small Finance Bank started in 2016.

- Now, there are 10 small finance banks in India.

Payment Bank in India

- Payment Bank was set up in 2015 on the recommendations of Nachiket Mor Committee 2014

- It must be a Public ltd. company with Rs.100 Cr. Capital.

- Payment Banks need to invest min 75% of deposits in Govt. bond as SLR

- They can deposit max 25% of deposits with other scheduled commercial banks.

- Max deposit can be Rs.1 lac per year per person is allowed.

- PBs can open branch and ATM

- They need to open 25% access point must be in rural area.

- Payment Banks can sell Mutual Fund, Pension, Insurance etc.

- PBs can accept only savings account, current deposits and fixed deposit.

- Min CRAR is 15% for payment banks.

- Max 74% FDI is allowed for PBs.

- PBs can access repo market.

- Payment banks in India can recruit Business Correspondents to serve financial services to customers.

- 1st payment bank in India is Airtel Payments Bank launched in 2017.

- Now, there are total 6 payment banks in India.

Payment Banks Cannot Do

- Lending activity, credit card or advance is not allowed for payment banks.

- They can’t accept NRI deposit and cross border remittance.

Wholesale Banking in India

- Wholesale banking is the provision of services by banks to larger customers or organizations

- Customers can be mortgage brokers, large corporate clients, mid-sized companies, real estate developers and investors, international trade finance businesses, institutional customers etc.

- Nachiket Mor Committee recommended Wholesale banking in India.

- Reserve Bank of India (RBI) has proposed setting up wholesale and long-term finance (WLTF) in 2017.

- It didn’t started yet

- Liabilities will be Current Account, Term Deposit (more than 10 Cr.), Bonds, Bank borrowing.

- Assets will be Infra project lending, medium corporate lending,

- Wholesale banks may sell PSL certificate to banks

- Proposed min paid up Capital Rs.1000 Cr.

banking in india types of banks

banking in india types of banks

Cooperative Banking in India

- Cooperative banks in India are registered under the Cooperative Societies Act, 1912.

- Cooperative banking is work on no–profit no–loss basis.

- They mainly serve small businesses, industries and self-employment in urban areas.

- In rural areas, they mainly finance agriculture-based activities like farming, livestock and hatcheries.

- Short-term rural cooperative has 3-tier structure

- Tier-I – state cooperative banks at state level

- Tier-II – central cooperative banks at district level

- Tier- III – primary agricultural credit societies (PACSs).

- They are run by an elected managing committee.

- In a cooperative bank, one shareholder has one vote.

- Cooperative banks issue shares of unlimited liability.

- Since 1966 it comes under the regulation of RBI.

- Cooperative banks can be scheduled or non-scheduled.

- NABARD provides refinance support and takes care of inspection of State CBs and District central CBs.

- Cooperative banks in India performs all the main banking functions of deposit mobilization, supply of credit and provision of remittance facilities.

- Cooperatives Societies have limitation to accept deposit from members only and lend to the same.

- CRR and SLR applicable on it

- Access of repo market is not allowed in Cooperative banking

- PSL is not applicable to cooperative banks.

- Long term cooperative banks or Land Development Banks are two types

- SCARDB – State Cooperative Agricultural and Rural Development Banks

- PCARDB – Primary Cooperative Agricultural and Rural Development Banks

- The earliest known cooperative credit union in India is Anyonya Sahakari Mandali, established in 1889 in Baroda.

Video Explanation

>>>>>>>>